What is a Tax Identification Number (TIN)? Complete Guide

September 8, 2025

7 minutes read

- TIN systems were established in 1936 with Social Security Numbers, expanding over decades to include business and non-resident categories as tax complexity increased.

- TINs contain built-in mathematical algorithms and check digits that help prevent fraud while maintaining taxpayer privacy through systematic number generation and validation.

- Beyond the IRS, TINs are used by Homeland Security, State Departments, federal agencies, and even businesses for identity verification and background screening processes.

Was reviewing some tax documentation earlier and realized how often TIN numbers get thrown around without explanation.

It’s everywhere – employment forms, business applications, bank accounts. People just expect you to know what it means.

The reality is, most people muddle through this without really understanding what they’re dealing with. They use their SSN when they should’ve gotten an EIN, or apply for the wrong type entirely. Then they hit walls – banks won’t open business accounts, tax software throws errors, or they realize they’ve been filing incorrectly for months.

But knowing which TIN you need and when can streamline everything. Makes the whole process smoother, especially if you’re handling anything more complex than basic W-2 employment.

What are Tax Identification Numbers? Official Definition

Say, as described by the IRS, a TIN is “a Taxpayer Identification Number (TIN) is an identification number used by the Internal Revenue Service (IRS) in the administration of tax laws.”

This concept isn’t unique to the United States. Canada has Social Insurance Numbers, the UK uses National Insurance Numbers, and Australia has Tax File Numbers. Same basic idea everywhere.

Every government needs some way to track who owes what taxes. Names don’t work because too many people share names.

TIN Types

We’re going to keep this section brief – if you want detailed information about each type, we have an entire guide dedicated to TIN Types.

Talking about the TIN system of the United States, there are five main categories:

- Social Security Number (SSN) – Standard identification for US citizens and permanent residents

- Employer Identification Number (EIN) – Required for businesses with employees or certain business structures

- Individual Taxpayer Identification Number (ITIN) – For non-residents who need to file US tax returns but aren’t eligible for SSNs

- Adoption Taxpayer Identification Number (ATIN) – Temporary number for children in the adoption process

- Preparer Taxpayer Identification Number (PTIN) – Required for paid tax preparers

Each serves a specific purpose within the broader tax identification framework.

How to Get a TIN in the United States?

The application process depends on what type you need.

| TIN Type | Where to Apply | What You Need |

| SSN | Social Security Administration | Proof of identity, age, citizenship/immigration status |

| EIN | IRS website (online) | Business information, responsible party details |

| ITIN | IRS (Form W-7) | Tax return or valid reason, identity documents |

| ATIN | IRS (Form W-7A) | Adoption documentation, identity proof |

| PTIN | IRS online system | Preparer credentials, background check |

Most people start with an SSN since that covers basic tax situations. Business owners usually need an EIN on top of that.

Tax Identification Numbers by Region

| Country | Tax ID System | Format |

| United States | TIN/SSN/EIN | XXX-XX-XXXX / XX-XXXXXXX |

| Canada | Social Insurance Number (SIN) | XXX-XXX-XXX |

| United Kingdom | National Insurance Number | XX XX XX XX X |

| Australia | Tax File Number (TFN) | XXX XXX XXX |

| Germany | Steuerliche Identifikationsnummer | XXXXXXXXXXX |

| France | Numéro fiscal de référence | XXXXXXXXXXXXX |

| Japan | My Number | XXXXXXXXXXXX |

| India | Permanent Account Number (PAN) | AAAAANNNNA |

| Brazil | Cadastro de Pessoas Físicas (CPF) | XXX.XXX.XXX-XX |

| Mexico | Registro Federal de Contribuyentes (RFC) | AAAANNNNNN |

| China | Taxpayer Identification Number | XXXXXXXXXXXXXXXXXX |

| South Korea | Resident Registration Number | XXXXXX-XXXXXXX |

| Singapore | NRIC/FIN | TXXXXXXXA |

| Netherlands | Burgerservicenummer (BSN) | XXXXXXXXX |

| Sweden | Personnummer | XXXXXX-XXXX |

| Italy | Codice Fiscale | AAAAAANNANNANNNA |

| Spain | Número de Identificación Fiscal (NIF) | XXXXXXXXA |

| Russia | Individual Taxpayer Number (INN) | XXXXXXXXXXXX |

| South Africa | Tax Reference Number | XXXXXXXXXX |

| New Zealand | IRD Number | XXX-XXX-XXX |

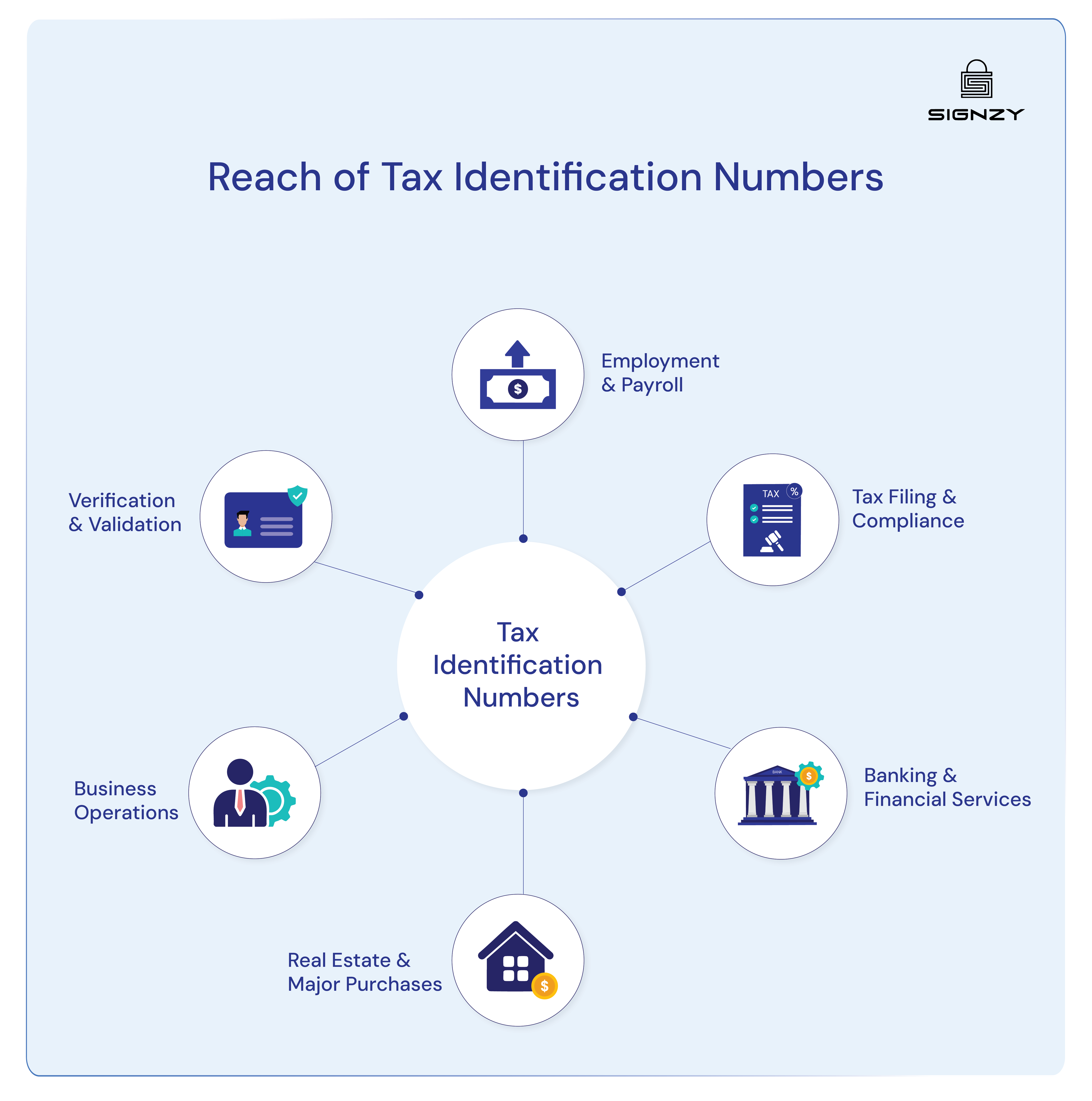

Where are TINs Used?

TIN numbers show up in basically every financial interaction you have.

-

Employment and Payroll

Your employer needs your TIN for everything. Payroll setup, tax withholding, and year-end W-2 forms. No TIN means no legitimate employment. HR departments verify these numbers before processing new hires. Contractors need to provide TINs on 1099 forms, too. Even part-time work requires a valid tax identification.

-

Banking and Financial Services

Banks won’t open accounts without TINs. Every financial institution needs these numbers for regulatory compliance and tax reporting. They are also required for:

- Investment Services – Brokerage accounts, retirement plans, and investment platforms need TINs for 1099 reporting

- Lending Products – Mortgages, personal loans, and credit cards require TIN verification for credit checks and tax reporting.

- Digital Payments – Cryptocurrency exchanges, payment processors, and fintech apps now mandate TIN collection for significant transactions.

- International Transfers – Wire transfers and large money movements trigger enhanced TIN verification requirements.

Basically, financial institutions can’t process most services without proper tax identification on file.

-

Tax Filing and Compliance

Every interaction with the IRS revolves around your TIN. It’s how they track everything from your first job to retirement. You’d want the TIN number for:

- Annual returns

- Quarterly payments

- IRS correspondence

- Amended returns

- Extension requests

- Payment plans

The entire tax system runs on TIN-based identification and tracking.

-

Government Benefits and Services

Social Security benefits are tied to your SSN. Unemployment claims require TIN verification. Medicare enrollment uses SSNs for identification. Veterans’ benefits link to military service records through TINs. Even jury duty notices often reference tax identification numbers.

-

Real Estate and Major Purchases

Home purchases require TINs for mortgage applications and tax record transfers. Property tax assessments link to owner TINs. Real estate investment reporting needs TINs for rental income and depreciation schedules. Vehicle purchases over certain amounts may require TIN documentation.

-

Business Operations

Business bank accounts need EINs. Credit applications require TINs for business owners and guarantors. Vendor applications ask for TINs before setting up payment terms. Government contracts mandate TIN verification before bidding. Many B2B relationships won’t start without proper tax identification numbers on file.

-

Verification and Validation

All these uses create verification needs for businesses and organizations. Banks verify TINs before account opening. Employers check TINs during hiring. Landlords verify TINs for rental applications.

The problem is, TINs get used so much that verifying them becomes a real headache. You can’t just trust what people write down – typos happen, fraud happens, systems need to actually check these numbers work.

Even calling the IRS to verify every single TIN isn’t realistic. Neither is it manually cross-checking databases. Companies end up with backlogs of applications sitting around waiting for verification.

That’s where automated verification platforms come in. Instead of manual processes that take days or weeks, you can verify TINs instantly through API integrations like Signzy’s EIN Verification API or SSN Verification API. Here’s an example process:

- Integration – Connect Signzy’s verification API to your application forms or onboarding system

- Real-time Check – When customers enter TIN information, the system automatically verifies against official databases

- Instant Results – Get immediate validation results – valid, invalid, or flagged for manual review

- Process Decision – Approved applications move forward automatically, flagged ones go to human review

The best part is, thanks to API infrastructure, you can integrate verification at whichever step you like. This gives room to conduct A/B tests and reduce drop-offs as much as possible.

Book a demo with Signzy here to see the process in action.

FAQs

Can I use my ITIN instead of an SSN?

ITINs are specifically for tax filing purposes and cannot replace SSNs for employment, Social Security benefits, or other non-tax uses.

Is my Social Security Number the same as a TIN?

Yes, your Social Security Number functions as your TIN for most personal tax situations. SSN is the most common type of TIN used by individuals.

Do I need a separate TIN for my business?

Most businesses need an Employer Identification Number (EIN), which is a different type of TIN. Even sole proprietors may need an EIN for business banking.

How long does it take to get a TIN?

SSN applications take 2-3 weeks. EIN applications are processed immediately online during business hours. ITIN applications take 7-11 weeks to process.