US Crypto Regulations 2025: AML Compliance & General Setup

July 29, 2025

7 minutes read

- All states except Montana require money transmitter licenses for crypto businesses.

- FinCEN registration is federal and free but doesn’t authorize operations. State licenses actually permit you to conduct money transmission activities legally.

- Crypto platforms must conduct real-time OFAC screening for all transactions plus periodic re-screening of existing customers, typically monthly or quarterly.

Crypto compliance finally makes sense in 2025.

Remember when every lawyer gave you different advice about the same regulation? When you weren’t sure if accepting Bitcoin meant you needed a money transmitter license? Those days are mostly behind us.

The regulatory picture is clearer now. FinCEN has straightforward AML guidelines, most states have reasonable licensing processes, and banks are actually willing to work with compliant crypto businesses.

Sure, there’s more paperwork than the early days, but there’s also more certainty. You can build long-term strategies instead of constantly wondering if your business model is going to be legal next month.

If you’re operating in the US crypto space, here’s what compliance looks like today – the actual requirements.

AML Regulations for Crypto Businesses in the US

The Bank Secrecy Act treats crypto businesses like any other money services business.

That means you need the same four pillars of AML compliance plus proper customer verification, bringing the total to five. But guess what? There’s something more as well! Read on to find out.

1. Compliance Officer

Every Money Services Business (MSB) must designate someone to manage its AML responsibilities (more MSBs in a minute). This person is responsible for:

- Overseeing the development and execution of the AML program

- Keeping your AML policies current

- Flagging and reporting suspicious activity

- Acting as the point of contact for FinCEN and other regulators

Without a named officer, regulators see your program as incomplete. Having someone directly accountable helps prevent gaps and prepares your team for audits.

2. Training

Everyone who touches customer funds or transaction data needs AML training. Not just your compliance team – your customer service reps, your developers, even your marketing team if they’re handling customer communications.

Training covers recognizing suspicious activity, understanding reporting requirements, and knowing when to escalate issues. More importantly, you also need to document who completed the training and when. Regulators will ask for these records during examinations.

3. Internal Controls

Internal controls are the systems and documentation that shape how your business handles compliance day to day.

There are three standard internal control components include:

- Written AML policy documents tailored to your risk profile

- Risk assessments that consider customer types, geographies, and transaction patterns

- Recordkeeping systems that log and retain data in line with FinCEN requirements

These controls help make sure compliance is part of your workflow, not just something you do after a problem comes up. Weak controls are often the reason firms get flagged during audits.

4. Independent Testing

Get someone independent to test your AML program every year. This can be an outside firm or your internal audit team, but it can’t be the same people running day-to-day compliance.

They should test whether your transaction monitoring actually works, whether your risk assessments make sense, and whether your staff follow procedures. When they find problems (and they will), fix them quickly and document what you did.

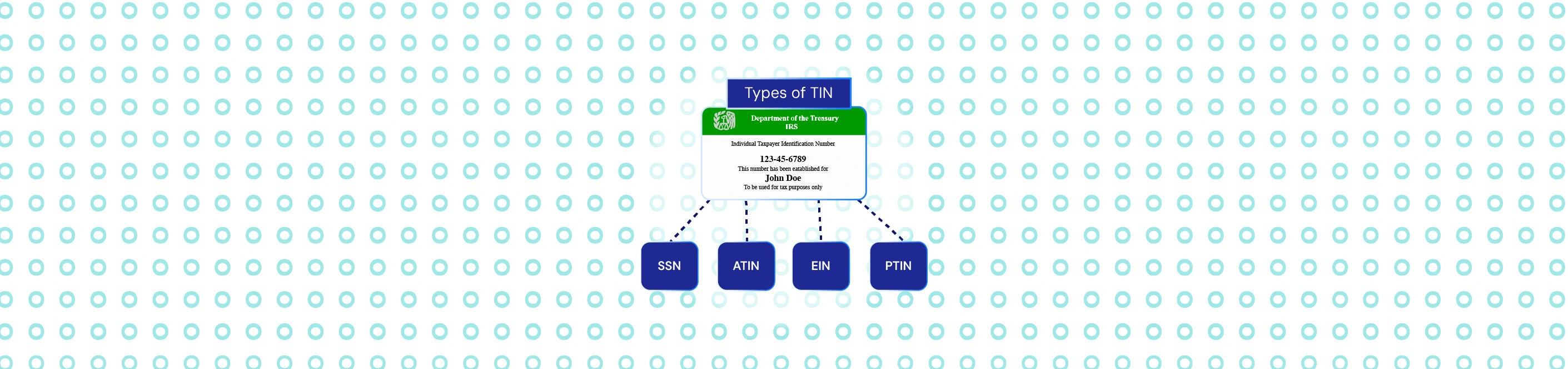

5. Customer Due Diligence Requirements

Customer due diligence (CDD) brings everything together. This is where your internal controls, staff training, and monitoring technology intersect. What CDD includes:

- For individual customers: Collect name, address, date of birth, and identification documents.

- For businesses: Collect formation documents, ownership information, and details about their operations.

On top of these, enhanced due diligence applies to higher-risk customers like politically exposed persons, customers from high-risk jurisdictions, or those with unusual transaction patterns. This means additional documentation, sanction screening, and ongoing monitoring.

6. Other Requirements

Beyond the five core AML pillars, here are a few more boxes you need to check that regulators are actually enforcing now.

- Travel Rule compliance: For transactions over $3,000, you need to collect info about who’s sending and who’s receiving to the other platform. This used to be more of a suggestion – not anymore.

- OFAC compliance & screening: When any of your users pop up on the SDN list, you need to block them immediately and file reports with OFAC. Most platforms run automated screening because doing it manually is asking for trouble.

- Suspicious Activity Reporting (SAR): When something looks fishy, you have 30 days to file a SAR. Keep all your investigation notes and supporting docs because regulators will want to see your reasoning. The key is showing you actually investigated, not just filed a report to cover yourself.

- Record retention requirements: Keep everything for five years – customer docs, transaction logs, training records, and the works. Organize it so you can actually find stuff during exams instead of scrambling through random files.

Get these four things right, and you’ll handle most of what regulators actually care about during examinations.

MSB and FinCEN Registration Requirements

If you’re handling customer funds or facilitating crypto transactions, you’re probably operating as a money services business, whether you realize it or not.

Register as an MSB with FinCEN within 180 days of starting operations. This is a one-time federal registration that costs nothing but requires annual renewals. You’ll need basic business info, details about your services, and information about key personnel.

Once registered, you’ll file periodic reports with FinCEN and maintain compliance with each state’s ongoing requirements.

State Money Transmitter Licenses (MTLs) Regulations

This is where it gets expensive and complicated. All states require separate licenses if you’re transmitting money or virtual currencies (except Montana).

Each state has different requirements, timelines, and fees. Some want surety bonds, while others require specific net worth minimums.

Plan on 6-18 months and anywhere from $50K to $500K+, depending on which states you operate in. Or maybe focus on states where you have actual customers or plan to have significant volume.

You can always add more licenses as you grow.

Money Transmission Modernization Act (MTMA) can streamline things

The Money Transmission Modernization Act is trying to solve the headache of getting 50 different state licenses with 50 different requirements. States would still issue their own licenses, but they’d all follow the same playbook.

MTMA has bipartisan support but no clear timeline for passage.

- If you’re just starting out, you might want to see how this develops before committing to expensive state licensing. As of 2025, 31 states have already enacted MTMA partially or fully.

- If you’re already operating, keep your current licenses active – there’s no guarantee this will actually happen, and even if it does, there will be a transition period.

Either wait or don’t build your business strategy around regulatory changes that haven’t happened yet.

Taking Extra Care: What to Do Next

You’ve got the framework – now you need to actually implement it without breaking your operations or budget.

Start with the basics: get your FinCEN registration done, pick 2-3 key states for licensing, and set up basic transaction monitoring. You can continually expand later.

The real pain point is usually identity verification. Manual KYC processes will kill your user experience and eat up your team’s time. Your compliance officer shouldn’t be spending all day reviewing driver’s licenses.

Automate what you can automate. Let good verification platforms handle the routine stuff – document checks, sanctions screening, risk scoring – so your people can focus on the actual suspicious cases that need human judgment.

If you’re drowning in manual verification work, Signzy offers RegTech solutions to streamline KYC processes in the form of scalable APIs.

FAQs

Can I operate while waiting for state licenses to be approved?

No, you must have licenses approved before operating in each state. Operating without proper permits can result in cease and desist orders.

Do I need licenses in every state?

Only in states where you have customers or conduct business activities. Many companies start with key states and expand gradually.

What happens if I get audited by regulators?

Regulators will review your AML program, transaction monitoring, customer records, and compliance procedures. Proper documentation and record-keeping are essential.

Can I use third-party services for compliance?

Yes, many companies outsource KYC verification, transaction monitoring, and compliance consulting while maintaining overall responsibility for their AML program.