How to Verify TIN Numbers in the US? Complete Guide [2025]

September 3, 2025

7 minutes read

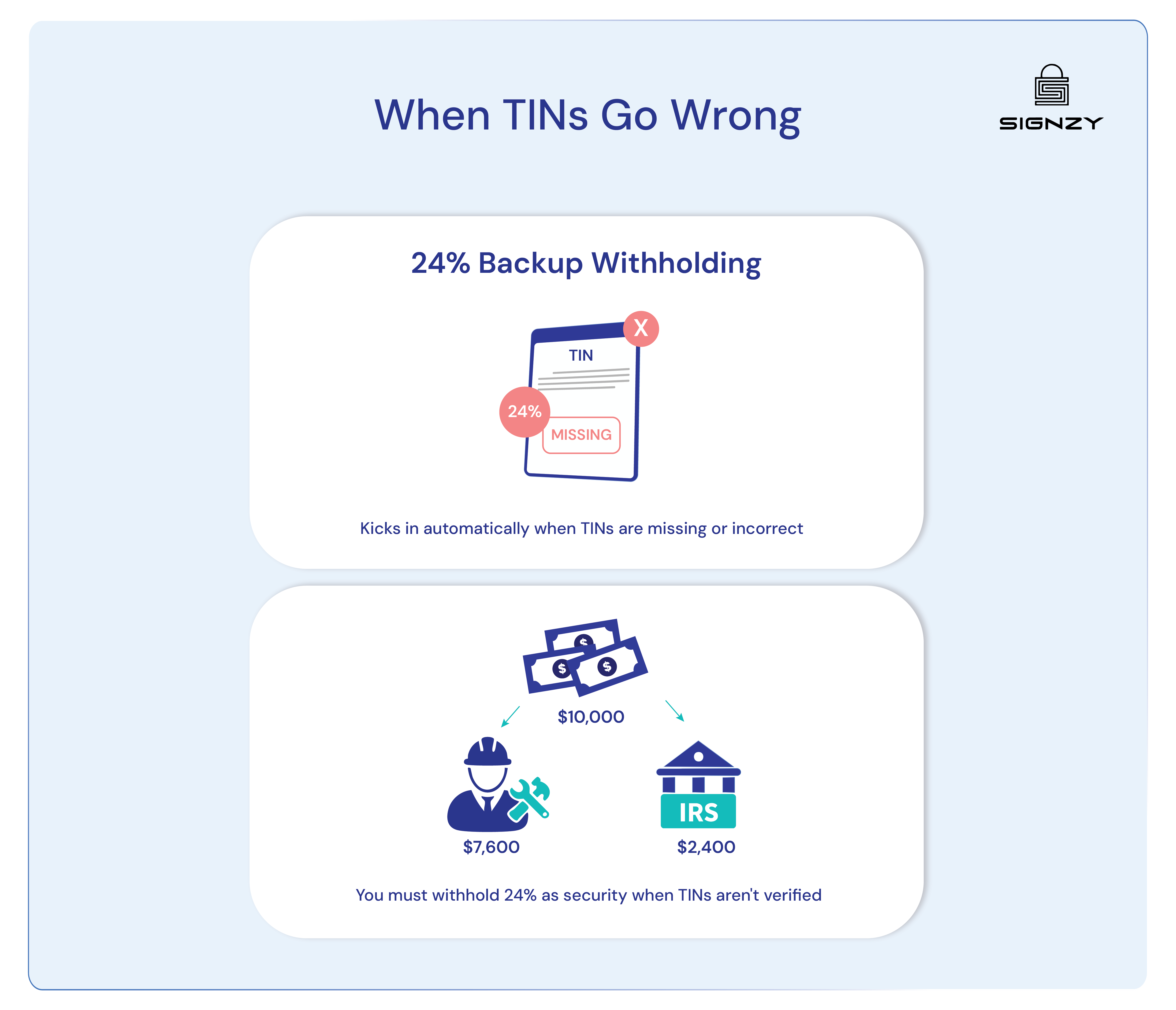

- Proper TIN verification helps businesses avoid backup withholding requirements, tax reporting errors, and potential IRS penalties that can impact cash flow.

- The IRS provides free TIN Matching services through their e-Services portal, though it requires registration and can take several days to process.

- Different business scenarios like payroll, contractor payments, and partnerships have specific TIN verification needs based on federal tax regulations and reporting requirements.

Need to verify a TIN number? You’ve come to the right place!

Whether you’re onboarding a new customer, working with a contractor, or just want to make sure your records are spot-on, verifying TIN numbers is actually pretty straightforward once you know where to look.

The best part? There is a free and easy way to check these numbers, and as well as paid options that allow for bulk verification. This guide covers both options so you can pick what works best for your situation.

We’ll also dive into the simple steps that’ll help you get this done quickly and accurately. But first, let’s understand the basics first.

What are Tax Identification Numbers (TINs)?

A Tax Identification Number (TIN) are unique nine-digit identifiers assigned to individuals and businesses for tax reporting purposes in the United States.

This system was established under the Internal Revenue Code to create a standardized way of identifying taxpayers across all federal tax processes, helping streamline everything from filing returns to processing payments.

In the US tax system, TINs come in several forms depending on your situation:

- Social Security Numbers (SSNs) – Nine-digit numbers used by individual taxpayers, including employees and self-employed individuals. These are the most widely used TINs for personal tax filings.

- Individual Taxpayer Identification Numbers (ITINs) – Nine-digit numbers designed for individuals who need to file US tax returns but aren’t eligible for a Social Security Number, such as non-resident aliens, dependents, or spouses of US taxpayers.

- Employer Identification Numbers (EINs) – Nine-digit numbers used by businesses, partnerships, corporations, and LLCs. Also called Federal Tax ID numbers, these help the IRS track business tax obligations and payroll responsibilities.

- Adoption Taxpayer Identification Numbers (ATINs) – Temporary nine-digit numbers used by adoptive parents to claim tax benefits for children in the adoption process who don’t yet have SSNs.

- Preparer Tax Identification Numbers (PTINs) – Numbers assigned to paid tax return preparers, required for anyone who prepares federal tax returns for compensation.

When you verify a TIN, you’re checking that the number exists in IRS records, is currently active, and matches the name associated with it.

This verification helps you maintain accurate records and ensures smooth tax reporting processes.

What Does TIN Verification Report Reveal?

When you run a TIN verification, you’ll get valuable information that helps confirm the accuracy of your records:

- TIN Validity Status – Whether the number is a legitimate, active TIN in the IRS system or if it’s invalid, expired, or formatted incorrectly.

- Name-TIN Match Confirmation – Verification that the name you have on file exactly matches the name associated with that TIN in IRS records.

- Account Status Information – Whether the TIN is currently active and in good standing, or if there are any issues that might affect tax processing.

- Format Validation – Confirmation that the nine-digit number follows proper TIN formatting rules and passes basic authenticity checks.

This information gives you the confidence to move forward with payroll processing, contractor payments, or business partnerships, knowing that your tax documentation will be accurate and compliant.

Where is TIN Verification Used?

TIN verification serves many practical purposes across different business and personal scenarios:

-

Account Opening and Financial Services

Banks, credit unions, and investment firms use TIN verification to comply with Know Your Customer (KYC) requirements and ensure accurate tax reporting on interest, dividends, and other financial transactions.

-

Payroll Processing

When hiring new employees, HR departments need to verify Social Security Numbers and ensure they match employee names. This ensures accurate W-2 processing and helps avoid backup withholding requirements that can complicate payroll.

-

Contractor and Vendor Payments

Before issuing 1099 forms to independent contractors or service providers, businesses must verify TINs to ensure proper reporting. This prevents delays in year-end tax processing and maintains good relationships with contractors.

-

Business Partnership Setup

When forming partnerships, joint ventures, or other business relationships, verifying each party’s EIN helps establish legitimate business connections and ensures smooth tax reporting for shared ventures.

-

Real Estate Transactions

Property managers, real estate agents, and title companies verify TINs for buyers, sellers, and service providers to ensure accurate 1099 reporting and smooth closing processes.

How to Conduct TIN Verification?

There are two main approaches to verifying TIN numbers, each with its own advantages depending on your needs and volume. You can either handle verification manually using official resources, or streamline the process with technological solutions that automate the checking for you.

-

Manual TIN Verification

Manual verification involves using free resources provided by the IRS to check TIN validity on your own. The primary method is through the IRS TIN Matching system, where you can submit batches of name-TIN combinations for verification.

You’ll need to register for an IRS e-Services account, upload your data in the required format, and wait for the IRS to process your request and send back results. While this method is free, it can be time-consuming and requires you to handle the technical aspects of file formatting and submission yourself.

-

Technological Solutions

For businesses that need regular or high-volume TIN verification, automated solutions offer speed and convenience. While there are various providers in the market, we’re most familiar with how Signzy’s TIN verification works:

- Simple API Integration – Connect your existing systems directly to the verification service through straightforward API calls that fit into your current workflow.

- Real-Time Results – Submit TIN and name combinations and receive instant verification results without waiting for batch processing.

- Bulk Processing Options – Upload multiple TINs at once through a user-friendly interface or programmatically process large lists.

- Detailed Response Data – Get comprehensive verification reports including validity status, name matching, and TIN type identification.

- Compliance Documentation – Receive proper documentation of your verification efforts for audit trails and regulatory compliance.

- Dashboard Monitoring – Track your verification history, success rates, and usage through an intuitive management interface.

This automated approach saves time and reduces the manual effort involved in maintaining accurate TIN records for your business operations.

How Can Signzy Help with TIN Verification?

We get it – TIN verification can be a real pain, especially when you’re dealing with tons of records or need results fast. That’s exactly why we built our solution to take the headache out of the whole process.

✅ All TIN Types Covered: Whether you need to verify SSNs, EINs, or ITINs, we’ve got you covered. Plus, if you’re already using our KYC or KYB tools, TIN verification plugs right in without any extra hassle.

✅ Up and Running in Days: Seriously, most of our clients are verifying TINs within a few days. Just API integration is needed. Our team walks you through the setup so you don’t have to figure it out on your own.

✅ Built for Real Business Needs: We handle everything from one-off checks to massive batch processing. No downtime headaches, no security worries – just reliable verification when you need it.

Ready to ditch the manual TIN checking? Book a demo and we’ll show you exactly how much time this can save your team.

FAQs

Is TIN verification free?

The IRS offers free TIN matching services, but you’ll need to register and handle formatting yourself. Third-party solutions charge fees but offer convenience and speed.

Can I verify TINs in bulk?

Yes, both IRS TIN Matching and automated solutions support bulk verification. You can upload multiple TINs at once for batch processing rather than checking individually.

What happens if a TIN doesn't match the name?

A mismatch usually means incorrect information was provided. You’ll need to get the correct details from the individual or business before proceeding with payments.

Is TIN verification required by law?

While not always legally required, it’s strongly recommended to avoid backup withholding, ensure accurate tax reporting, and maintain compliance with IRS guidelines.