EIN and SSN: 10 Frequently Asked Questions [Business Owner Guide]

August 1, 2025

8 minutes read

- Business structure changes from a sole proprietorship to an LLC or corporation typically require obtaining a completely new EIN.

- SSNs work for domestic verification, but international contractors need W-8BEN forms and their local country tax IDs instead.

- EINs provide better privacy protection than SSNs and look more professional when opening business bank accounts.

Been getting hit with EIN and SSN questions nonstop lately. Reddit threads, client emails, random conversations at networking events. Same stuff over and over.

Contractors handing over fake tax IDs, people messing up SSNs on 1099s, employees who moved three years ago but never bothered updating their W-4. Then everyone panics when they realize the IRS penalties for this stuff went through the roof.

Spent some time digging into what actually works when these situations blow up. I talked to accountants, HR people, and business owners who’ve been there. Turns out most of this has pretty simple fixes if you know the right steps.

There are tons of these situations, but I narrowed it down to the 10 situations that cover the majority of problems.

1. How to Change or Correct My EIN Information?

Start by figuring out what’s changing. Did your business move? Change names? Did the responsible person change? The IRS needs updated info to keep your records accurate, make sure mail goes to the right place, and prevent future issues.

Here’s how to handle common updates:

- Business name change: Write a letter on your company letterhead. Include your EIN, old name, new name, and an authorized signature. Mail it to the IRS. Check gov for the correct address based on your state and filing type.

- Address or responsible party change: Fill out Form 8822-B to update your business address or responsible party. File it within 60 days. You can get the form and mailing info on IRS.gov.

- Change in business structure or ownership: If you switch from a sole proprietorship to an LLC or similar, you likely need a new EIN. The IRS treats this as a new business. Confirm with the IRS “Do You Need a New EIN?” tool. It takes just a minute.

Requests must come from the current responsible party or an authorized person. If that person has changed, include that info too, so the IRS updates their records.

After you submit, notify your bank, payroll provider, and business partners. You’ll only get a new EIN if your structure changes. If you’re unsure, check the IRS website or call the Business and Specialty Tax Line.

2. If you collect an invalid EIN from a contractor, the IRS puts the responsibility on you, not them. Every wrong 1099 costs $60 to $660 in penalties.

If the number doesn’t check out and you don’t fix it fast, you’re required to start backup withholding. That means you have to hold back 24% of their pay and send it to the IRS.

Keep doing it wrong, and your business could get flagged. The smart move? Use the IRS TIN Matching tool before paying or filing. Try at least three times to get the correct EIN and keep records. If you follow the rules, you stay in the clear, even if the contractor ghosts you.

3. Can I Use SSN for Verification in Global Transactions?

Social Security Numbers (SSNs) work well for US-based checks, but outside the US, they don’t hold much weight. If you’re working with international vendors or freelancers, an SSN usually won’t cut it.

Here’s what to do instead:

- Ask for their local tax ID and a W-8BEN Most countries issue their own version of a taxpayer ID, and this form helps you stay on the right side of US tax rules.

- Use a passport or government-issued ID to confirm who they are.

- Use a trusted ID verification service that can check international documents properly.

SSNs are fine for domestic use. But for global deals, you’ll need the right forms and IDs to stay compliant and keep things running smoothly.

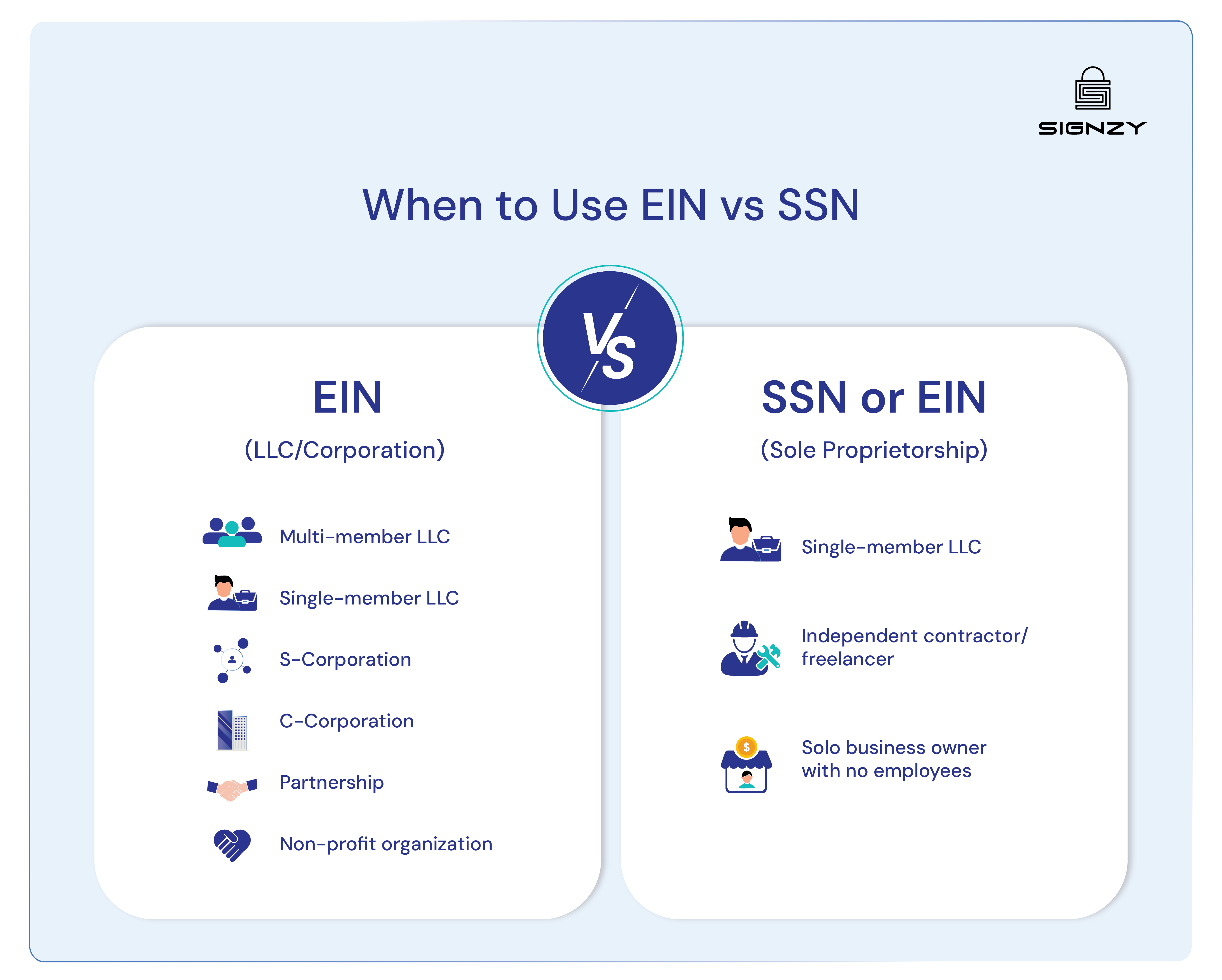

4. Can EIN Be Used Instead of SSN for Business Tax Reporting?

Yes, and honestly, it’s usually the better way to go. If you’ve set up an LLC or a corporation, you should be using your employer identification number (EIN) for anything tax-related. That’s what it’s for. But even if you’re a sole proprietor, the IRS lets you use your SSN, though that doesn’t mean you should.

Getting an EIN is a good idea anyway. It helps keep your personal information private and keeps your business records separate, which matters a lot when it comes to taxes, hiring employees, or opening a business bank account.

5. Can I Deduct Payments Made to Contractors with Invalid EINs?

You can, but it might come back to bite you. If the EIN doesn’t match what the IRS has on file, it could hold up your return or raise questions that delay the deduction. Play it safe: check the number before you send any money. The IRS has a TIN Matching tool that takes just a few minutes to use.

Double-check that your 1099s are accurate and filed on time. If you find out the number’s wrong, follow up with the contractor. The IRS expects you to try at least three times to get the correct one, and you need to keep a record of each attempt. Verifying early and keeping those records protects your deduction and saves you stress when tax season hits.

6. How to Handle a Lost or Stolen SSN Card? Steps to Take Immediately

If someone on your team loses their SSN card, treat it like a security issue, not just lost paperwork. First, head to IdentityTheft.gov to report any possible misuse. They’ll guide you on how to protect their identity. It’s smart to freeze their credit with all three major bureaus to stop any fraud before it starts. To replace the card, they can log into their Social Security account or visit a local SSA office.

On your end, update your records and keep an eye out for payroll or tax mix-ups tied to that SSN. In some cases, filing a police report and placing a fraud alert can help. Moving fast lowers the chance of identity theft and keeps your systems safe.

7. How to Correct an SSN Error

If an SSN is entered incorrectly on a tax form, it needs to be fixed immediately. Leaving it uncorrected could create problems for both your business and the individual.

Steps to fix it:

- For W-2 forms: File Form W-2c with the correct SSN.

- For 1099s: Issue a corrected version and check the “Corrected” box.

- Inform the employee or contractor: They will need the updated form for their tax return.

Always cross-check ID documents when collecting SSNs to prevent these errors in the first place.

8. What Happens If I Misuse an SSN: Legal Consequences

Misusing someone’s Social Security Number, even by accident, can land you in serious trouble. It is not just about fixing a form or sending an apology.

You could also be hit with civil fines ranging from $250 to $5000 for each violation. And if you use a fake or stolen SSN, that could lead to felony charges. Beyond that, there is also the risk of privacy lawsuits if the number is mishandled or exposed in any way.

The best way to protect your business is by being proactive. Limit who has access to SSNs, use secure systems to collect and store them and only keep the information as long as needed. These simple habits can help you avoid legal issues and keep your operations safe.

9. What Verification Is Required Before Issuing 1099s?

Before sending a 1099, don’t just take the contractor’s word for it. You need to verify their identity and TIN. Start by having them fill out a W-9 with their legal name and TIN. Next, run it through the IRS TIN Matching tool to make sure it lines up.

If it passes, you’re set. If it doesn’t, you’re allowed up to three tries to get it right. Just be sure to keep a record of each one. This simple step helps keep your 1099s accurate and your filings compliant.

10. How Do I Know If a Contractor’s EIN or SSN Is Legitimate?

Verifying a contractor’s EIN or SSN is your responsibility. Start by asking the contractor to complete and sign a W-9 form. Then, use the IRS TIN Matching Program to confirm the name and number match IRS records. You can also ask for supporting documents. For an EIN, request the IRS Confirmation Letter called CP 575. For an SSN, you may ask for a valid photo ID if needed.

If you’re onboarding many contractors, manual checks might not be enough. That’s where automated solutions Signzy’s API can help you conduct verifications with official databases at scale.

Book a demo with Signzy and see how automated verification works.