Decoding the recent amendment of the RBI’s Master Directions on Regulatory Framework for Microfinance Loans

July 29, 2025

8 minutes read

The Reserve Bank of India is entrusted with many vital responsibilities—one such is taking care of the financing needs of the people of India. For this, it issues notifications, circulars, guidelines, etc.

Beginning in January 2016, the Reserve Bank of India began issuing Master Directions on all regulatory matters. The Reserve Bank’s guidelines for banking matters and foreign exchange operations, among other Acts, are consolidated in the Master Directions.

July 17, 2025: a landmark day for amendments brought to the framework around Microfinance Loans

Amendments to such master directions change the course of business and compliance for all involved, and one such amendment was declared by the Reserve Bank of India on July 17, 2025, w.r.t. Microfinance loans.

On July 17, 2025, the Reserve Bank of India issued the Master Direction—Reserve Bank of India (Regulatory Framework for Microfinance Loans) Directions, 2022. These Directions have brought with them an ocean of changes about what can and cannot be a part of KFS, repayment obligations, assessment of household income, etc., impacting commercial banks, NBFCs, and other lending agencies on one hand and the rural and suburban crowd, mainly, on the other.

It is a very favourable Direction for the people of India who do not have access to credit easily, and at the end of this blog, you will know why we are saying that!

So let us get into it.

What is a microfinance loan?

The keyword of this whole blog is ‘microfinance.’ So, before we can take a deep plunge into how this update from the Reserve Bank of India has impacted many businesses, let us comprehend the meaning of the term microfinance loan.

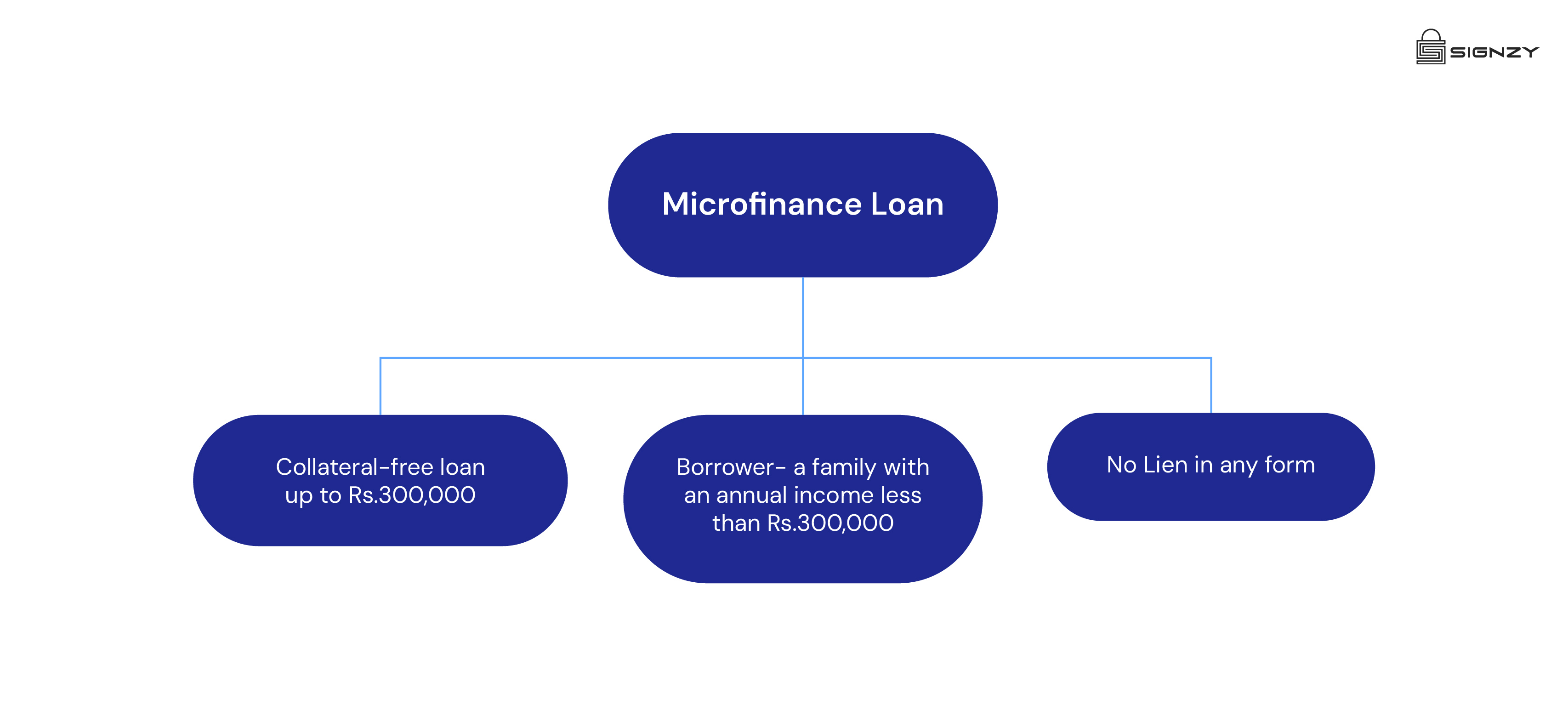

Here are a few characteristics to know and categorise a microfinance loan:

Collateral-free loan up to ₹300,000 – A microfinance loan is any loan provided to a household with an annual household income of up to ₹300,000 without the need for collateral.

Now, you must be wondering what the term household means.

Do not worry; we have got a lucid explanation for the term ‘household’—it means one family unit, which typically consists of a husband, his wife, and their unmarried children.

Can any household which checks the above idea avail this loan? The answer is a big No!

So, who can avail of this microfinance loan?

This loan is designed for families who fall into the low-income household criteria, i.e., a family with an annual income less than ₹300,000. These loans shall be disbursed without any lien and regardless of their intended use or method of application, processing, or disbursement.

The intent of it being collateral-free is at the core of this financing. The Reserve Bank of India has stated with utmost clarity that no lien, not even on the money deposited by the borrower, shall be created. This will be a huge relief for many families, especially in rural and suburban parts of the country.

In fact, the borrowers will have the liberty to design their own repayment schedules. Since this is very high risk for the lenders, the Reserve Bank of India has given a way out of this as well.

The Regulated Entities shall be required to do one thing as a priority—a board-approved policy that allows microloans to have flexible repayment schedules based on the needs of borrowers.

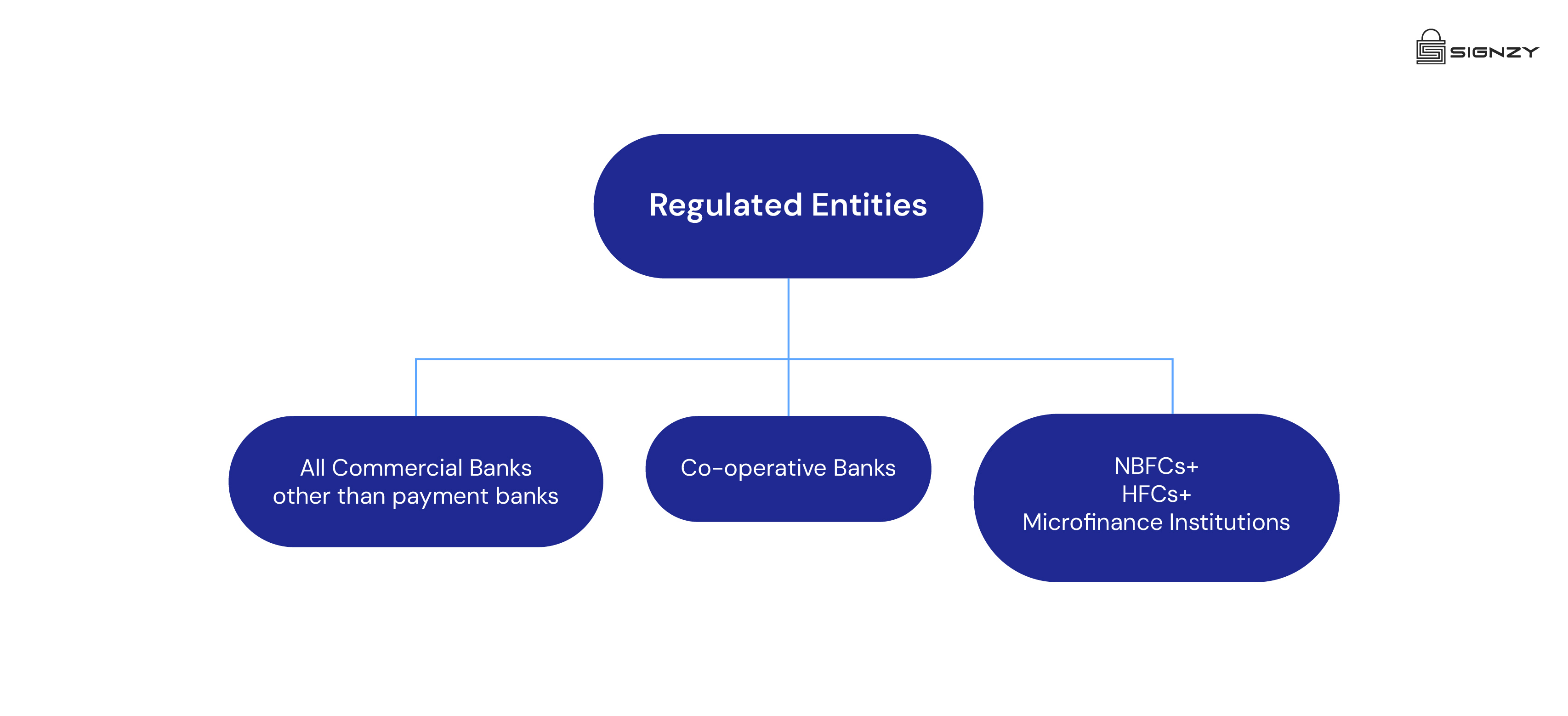

Who are ‘Regulated Entities’?

(i) All Commercial Banks other than payment banks—so it will broadly include the Small Finance Banks, Local Area Banks, and Regional Rural Banks;

(ii) All Primary (Urban) Co-operative Banks/State Co-operative Banks/District Central Co-operative Banks; and

(iii) All Non-Banking Financial Companies, which will also have in their ambit the Housing Finance Companies (HFCs) and Microfinance Institutions

Good news for NBFC-MFIs—the definition of “microfinance loans” is in line with the definition of “qualifying assets” of NBFC-MFIs.

Based on the earlier guidelines, any NBFC that did not meet the requirements to be classified as an NBFC-MFI was permitted to offer microloans only up to 10% of its total assets. These limits have changed. Now, the maximum loan amount for microlending has been increased to 25% of total assets, which will be a great boost!

So, if you are any of the above and are in the business of providing microfinance loans, this blog is for you. We have tried to narrow down the compliance checkpoints and turned them into an easy guide for all our readers:

The first and foremost step for all REs must be to see who can avail of this loan, and for that, the criteria of their household income must be assessed.

Assessment of Household Income by Banks

Here are a few steps REs must take as part of the ‘assessment of household income’ criteria:

Policy on Assessment of Household Income: Put in place a household income assessment policy that has been approved by the Board of Directors. The Reserve Bank of India has also provided a sample of what can come under this policy. The RE can suitably modify this model, post getting the approval of its Board of Directors, from time to time.

Information to CIC: Every RE is required to provide the Credit Information Companies (CICs) with information about household income. Before updating the assessed family income with CICs, the borrower or borrowers must be particularly asked for the reasons for any discrepancy between the assessed household income and the previously reported household income.

Repayment Obligations of the Borrowers

- Regarding the cap on outflows due to a household’s monthly loan repayment requirements as a proportion of monthly household income, each RE must have a board-approved policy. This will be limited to no more than 50% of the household’s monthly income.

- All of the household’s outstanding loans, including both collateralized and collateral-free microloans, will be considered for calculating loan repayment obligations by RE. The cap of 50% mentioned above shall take into account repayments of all current loans, including principal and interest, as well as the loan in question.

- At all times, REs must not falter with their level of indebtedness as allowed by law. For this, they must use the data available from CIC as well as from their additional sources, including the borrowers’ declarations, bank account statements, and local inquiries.

Interest Rate and Pricing of the Loan:

- 1. Board approved Microloan Pricing Policy

- 2. No usurious interest rates or other fees.

- 3. No prepayment penalties.

- 4. Prior intimation to borrower for revision in ROI

Interesting compliances REs must keep in mind when designing the pricing of the microfinance loan overall:

- Every RE must implement a board-approved policy pertaining to microloan pricing.

- Microfinance loans shouldn’t have usurious interest rates or other fees.

- Microloans have no prepayment penalties. If there is a penalty for late payment, it will be applied to the amount that is past due rather than the total loan amount.

- The borrower must be notified well in advance of any changes to the interest rate or other fees, and these changes will only take effect prospectively.

Key Fact Statements and the compliance around:

- 1. KFS has to be in a language the borrower can understand

- 2. Acknowledgement from the borrower that he/she have understood the KFS

- 3. All third-party fees shall be a part of the KFS

- 4. No charges/fees not mentioned in the KFS can be levied

KFS is like the most vital part of the loan agreement and here is the why behind it.

- To begin with, and for readers who come from a non-banking background or are borrowers, a Key Facts Statement (KFS), which is given to the borrower in a standardised format, is a summary of the important details of a loan agreement in plain, understandable language.

- REs are required to issue a KFS to all potential borrowers in order to assist them in making an educated decision before signing the loan contract.

- The KFS will be written in a language that these borrowers can understand.

- Not just that the borrower will be given an explanation of the KFS’s contents, but also the REs must take an acknowledgement from the borrower that he/she has comprehended them.

- Third-party charges, such as legal fees, insurance charges, etc., which the RE actually collects from the borrowers, will also be included in the APR and reported separately. In fact, the RE will be obligated to provide the receipt of such charges as well to the borrowers.

- At no point throughout the loan’s term may the REs charge the borrower any fees, charges, etc. that are not specified in the KFS.

How Signzy can help

As lenders align with the new RBI guidelines, digitization can significantly ease the compliance burden. Signzy’s Contract360 solution is purpose-built for regulated entities, enabling borrower-friendly consent flows, automated generation of Key Fact Statements and APR disclosures, and seamless execution of digitally signed, multilingual contracts. With embedded compliance-by-design, trusted use across RBI, IRDAI, and SEBI-aligned institutions, and easy-to-integrate APIs and UI widgets, Signzy helps lenders move fast, without missing a step on compliance.