FBO Accounts Explained: How They Work, Legalities, and More

September 9, 2025

8 minutes read

- FBO accounts create a unique arrangement where one party controls the account while another party legally owns the funds, enabling secure third-party money management.

- FBO structures can help fintechs avoid costly state money transmission licensing by ensuring customer funds remain under bank control rather than company control.

- FBO accounts involve multiple layers of federal and state regulations, including new FDIC rules requiring enhanced record-keeping and daily reconciliation requirements.

Your 401(k) statement probably shows some weird account name you’ve never seen before. My friend’s was ‘Fidelity FBO Sarah Johnson’, and she thought someone had hijacked her retirement money.

Turns out, that’s totally normal. FBO means ‘For Benefit Of,’ and it’s basically how companies hold your money without actually owning it. Think of it like a safety deposit box – the bank has the key, but everything inside belongs to you.

These accounts are everywhere once you notice them. Your kid’s 529 plan? Probably an FBO account. That inheritance sitting in probate? Yep, FBO account. So, this explainer is for anyone who’s ever stared at a confusing account statement and wondered what the heck was going on.

What is an FBO Account?

An FBO account is essentially a middleman bank account. One party (like a trust company or broker) opens and manages the account, but all the money inside legally belongs to someone else: the beneficiary. It’s like having a personal assistant handle your banking while you retain full ownership of every penny.

But here’s where it gets interesting. FBO accounts work completely differently from the accounts you’re used to:

| Account Type | Who Opens It | Who Owns the Money | Who Controls It | Tax Reporting |

| Regular Checking | You | You | You | Your SSN |

| Joint Account | You + Spouse | Both of you | Both of you | Both SSNs |

| Trust Account | Trustee | Beneficiary | Trustee | Beneficiary’s SSN |

| Business Account | Company | Company | Authorized signers | Company’s EIN |

| FBO Account | Custodian/Broker | Beneficiary | Custodian/Broker | Beneficiary’s SSN |

The magic happens in that last column. Even though someone else controls an FBO account, YOU get all the tax documents.

Now that you understand the mechanics, let’s look at what actually happens when money moves through these accounts.

What Does Daily FBO Account Transaction Processing Look Like?

Think of Fidelity’s back office as a massive sorting facility that never sleeps. Every day, they process millions of transactions across thousands of FBO accounts, ensuring each penny lands in the right beneficiary’s record.

- Overnight systems gulp down huge files from employers – payroll contributions, new employee enrollments, people quitting, and cashing out.

- Each transaction gets matched to the right person using employer codes and social security numbers, kind of like a postal sorting machine.

- If you’ve set up automatic investing (like 60% stocks, 40% bonds), the system buys those investments for you without asking.

- Your account balance updates to show the new money, plus whatever your investments gained or lost that day

- Anything that doesn’t match perfectly gets kicked to a human – maybe someone fat-fingered an account number, or there wasn’t enough money for a withdrawal.

- Throughout the day, people request distributions or loans, and those are processed in real-time instead of waiting for the overnight batch.

- At the end, Fidelity runs a final check to make sure every dollar they received matches every dollar they’ve allocated to individual accounts.

This whole circus happens invisibly while you’re just trying to check if your 401(k) went up this month.

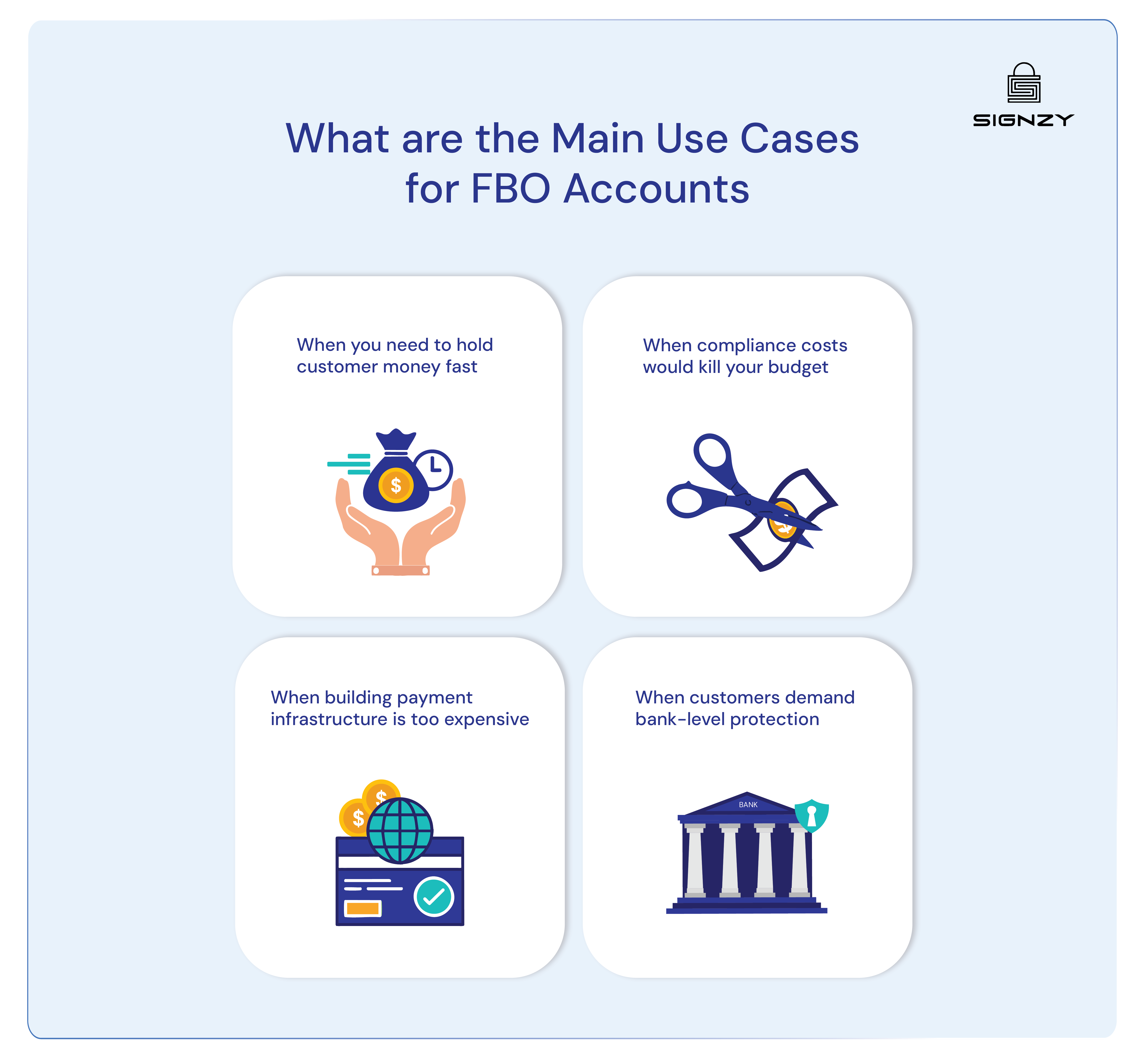

What are the Main Use Cases for FBO Accounts?

FBO accounts let fintechs hold customer money without actually becoming banks.

✅ When You Need to Hold Customer Money Fast

Getting a banking license is a lengthy and expensive process that requires substantial legal fees, regulatory filings, and initial capital requirements. You need a dedicated compliance team, risk management infrastructure, and detailed business plans that regulators will scrutinize extensively.

Most fintech founders would rather spend that time building product features and acquiring customers. FBO partnerships completely change this equation:

- Partnership negotiation: Compare fee structures and integration capabilities across multiple banking partners

- Technical integration: Build API connections with the bank’s systems and set up fund flow processes

- Compliance setup: Complete required reviews, test transactions, and prepare for live customer funds

- Launch: Start processing real transactions while competitors navigate regulatory approval processes

The speed advantage often determines who captures market share first in competitive fintech verticals. While others wait for regulatory approval, you’re already serving customers and improving your product based on real usage.

✅ When Compliance Costs Would Kill Your Budget

Banks employ teams of compliance specialists who spend their careers mastering financial regulations. These professionals handle anti-money laundering monitoring, Know Your Customer requirements, and suspicious activity reporting.

Building this expertise internally requires significant hiring costs and ongoing training investments. FBO partnerships let you tap into this existing expertise through your banking relationship.

Your partner bank handles transaction monitoring for unusual patterns, manages regulatory reporting deadlines, and maintains the policies that satisfy regulators. You just need to maintain accurate customer records and fund allocation data.

✅ When Customers Demand Bank-Level Protection

FDIC insurance covers deposits up to $250,000 per depositor, per bank, which extends to FBO account beneficiaries. For your customers, this means their funds receive the same government backing as deposits at major traditional banks. This protection has remained consistent through various economic cycles and banking crises.

Here’s what this protection actually covers for different customer types:

- Individual users: Protection up to $250,000 across all their balances in your app

- Small business accounts: Separate $250,000 limit calculated independently from personal accounts

- Joint accounts: Coverage per co-owner, effectively expanding protection for shared accounts

- Business payroll accounts: Additional coverage for employee wage deposits held temporarily

This way, customers feel comfortable storing substantial amounts because they know government insurance backs their deposits, not just company promises.

✅ When Building Payment Infrastructure Is Too Expensive

Modern banking infrastructure represents decades of investment and testing. ACH networks process billions of payments annually. Wire transfer systems handle same-day settlement for urgent payments. Check processing networks can clear paper checks from thousands of banks nationwide.

Building even basic versions of these systems from scratch would require massive investment and years to achieve the reliability customers expect. FBO partnerships give you immediate access to battle-tested infrastructure. When a customer initiates a wire transfer through your app, you’re using the same Federal Reserve systems that major banks rely on.

What Regulatory Requirements Apply to FBO Accounts?

FBO accounts exist in a web of federal and state regulations that keep getting tighter every year.

The banking world got a wake-up call when Synapse went bankrupt, and thousands of people couldn’t access their money because nobody could figure out who owned what.

-

New FDIC Rules (2024)

Banks holding FBO accounts now have to reconcile customer balances every single day and file annual reports proving they know exactly whose money they’re holding. If you’re a bank executive, you personally have to sign off that your record-keeping systems actually work.

-

Money Transmission License

Here’s the weird part – using an FBO account might help you dodge state money transmission licenses, but it’s not automatic. Some states might still need a license. Others give you a pass if the bank truly controls the funds. It’s basically a state-by-state gamble.

-

Federal Anti-Money Laundering Rules

Just because you’re using an FBO account doesn’t mean FinCEN forgets about you. You still need to watch for suspicious transactions, verify customer identities, and possibly register as a Money Services Business. The feds don’t care whose name is on the bank account – they care about what you’re actually doing with the money.

-

Double Compliance Burden

Both you and your bank partner have to do full customer verification. So your customers get screened twice – once by you, once by the bank. It’s redundant and annoying, but regulators want both parties watching for problems.

-

Bank Partnership Fine Print

Your bank is going to make you sign agreements spelling out exactly who does what when it comes to compliance. They want proof you’re monitoring transactions properly and won’t leave them holding the bag if regulators come knocking.

As you can see, FBO accounts can help with some regulatory headaches, but they create new ones too.

So there you have it – everything you need to know about FBO accounts. Hope this helped decode how fintech apps actually handle money behind the scenes. That’s all for today!

If you’re building something that involves FBO accounts, you’ll probably need reliable bank account verification at some point. Signzy’s API handles that part smoothly – just in case it’s useful for your project.

FAQs

Can I open an FBO account as an individual?

Generally no. FBO accounts are typically opened by institutions like banks, trust companies, or fintechs on behalf of their customers. Individual consumers usually access FBO accounts through these service providers.

Is my money safe in an FBO account if the company goes bankrupt?

Yes, if properly structured. Your funds remain legally separate from the company’s assets and maintain FDIC protection. However, access might be temporarily delayed during bankruptcy proceedings.

Do I pay taxes on FBO account funds?

You’re responsible for taxes on earnings in FBO accounts since the funds legally belong to you. Tax documents get issued under your Social Security number, not the account operator’s.

Can I withdraw money directly from an FBO account?

No. You can’t walk into a bank and withdraw from an FBO account directly. All transactions must go through the account operator who manages access according to their terms.