Digitization has become a marvel of technological innovation. It is dramatically changing credit markets around the world. It is also creating opportunities for consumers and new market participants. However, there remain challenges for traditional financial institutions and regulators.

What are the 5cs Of Credit

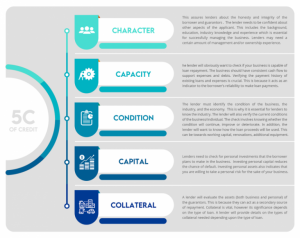

Credit analysis determines the risk involved with a loan and its borrower. A bank or lending institution will check your business & personal financial details. This comes regardless of the type of financing needed. Credit analysis can be broken into the “5 Cs:” character, capacity, condition, capital and collateral.

Character: This assures lenders about the honesty and integrity of the borrower and guarantors. The lender needs to be confident about other aspects of the applicant. This includes the background, education, industry knowledge and experience which is essential for successfully managing the business. Lenders may need a certain amount of management and/or ownership experience. One can assume the past is the best predictor for the future. On that note, a lender will examine the personal credit of all borrowers and guarantors as a precaution.

Capacity (Cash flow): The lender will obviously want to check if your business is capable of loan repayment. The business should have a consistent cash flow to support expenses and debts. Verifying the payment history of existing loans and expenses is crucial. This is because it acts as an indicator to the borrower’s reliability to make loan payments.

Condition: The lender must identify the condition of the business, the industry, and the economy. This is why it is essential for lenders to know the industry. The lender will also verify the current conditions of the business/individual. The check involves knowing whether the condition will continue, improve, or deteriorate. In addition, the lender will want to know how the loan proceeds will be used. This can be towards working capital, renovations, additional equipment, etc.

Capital: Lenders need to check for personal investments that the borrower plans to make in the business. Investing personal capital reduces the chance of default. Investing in personal assets also indicates that you are willing to take a personal risk for the sake of your business.

Collateral: A lender will evaluate the assets (both business and personal) of the guarantors. This is because they can act as a secondary source of repayment. Collateral is vital, however, its significance depends on the type of loan. A lender will provide details on the types of collateral needed depending upon the type of loan.

The above five components constitute an effective way of credit analysis. It also helps the lender understand the borrower and the business. By knowing each of the “5 Cs,” a better understanding of the loan application process and its requirements can be gained.

Need For Technology In Credit Analysis

In today’s digital environment, customers require excellence in terms of service. The demands are cumbersome when it comes to hassle-free and timely service rendition. Banking and financial services are one of the highest demand sectors in this regard.

Modern lending institutions are Constantly competing to win clients over. Utilizing software solutions can help meet those lofty demands. It can simultaneously mitigate credit risks as well.

The need for an improved credit management process

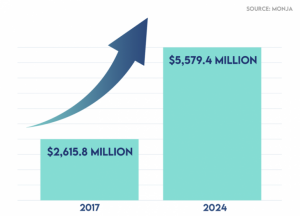

The traditional lending industry is adopting automated credit underwriting as the accepted norm. This shortens the wait time for clients. It also helps banks improve customer experience through a competitive environment. According to an article by Monja, the automated credit underwriting market stood globally at USD 2,615.8 million in 2017. It is predicted to grow up to USD 5,579.4 million by 2024. This will reflect a CAGR of 11.6% over the forecast period. The traditional lending industry is adopting automated credit underwriting as the accepted norm. This shortens the wait time for clients. It also helps banks improve customer experience through a competitive environment. According to an article by Monja, the automated credit underwriting market stood globally at USD 2,615.8 million in 2017. It is predicted to grow up to USD 5,579.4 million by 2024. This will reflect a CAGR of 11.6% over the forecast period.

The paper-based process causes delays in credit estimation, loan approval and releases. Time, as well as the cost of processing each loan application, can be reduced drastically. This requires a streamlined credit management process to replace legacy methods.

Hence, only automation can be the messiah to deliver an immense improvement in the current practice of extending loans. Lending firms that continue to be cynical about the efficiency of automation would be losing a lot. This includes clients, business opportunities, and more importantly revenue.

The paper-based process causes delays in credit estimation, loan approval and releases. Time, as well as the cost of processing each loan application, can be reduced drastically. This requires a streamlined credit management process to replace legacy methods.

6 Reasons Why Digitization Is The Need Of The Hour

Customer expectations. Banks traditionally depend upon physical distribution methods. Recently, it has been challenging to meet changing customer needs for speed and simplicity. Demands like fast online credit approvals are growing. A Report by Mckinsey highlights how the customer needs for online and mobile experience will grow 4X by the end of 2020.

Reduce back and forth client interactions

The current process requires scanning, emailing, and faxing financial information and supporting documentation, . This can be a strenuous back-and-forth process. Customer-facing interactive portals and APIs can easily enable the digital capture of such information.

Eliminate unnecessary manual work: The amount of unnecessary manual data entry can be easily reduced. Leveraging a portal that connects to the borrower’s financial accounting package is the answer. It should also support the technology to read tax forms digitally,

Make quicker and smarter decisions: The time required to generate financial spreads can be reduced. The application of innovative machine-learning technology is perfect for this.

Improved risk mitigation: Risk reduction is the main goal of any lender. Automation technology using AI can easily help in this area. The system will use the rules you define and analyze entire credit applications in seconds. It also reports reporting every error it detects. AI can handle redundant tasks at a higher speed and with lower error chances.

Pressure on cost and returns. The new players in the market are challenging incumbents’ revenues and their cost models. The conventional form of banking operations, branch networks, and legacy IT systems can be cumbersome. Fintech companies can operate at much lower cost-to-income ratios. This is approximately 40 percent lower according to a report by McKinsey.

How Automation Can Transform The Credit Analysis & Lending Landscape

The operational problems present in a manual paper-based solution can be complicated. The automation of credit analysis and the digitization of the key steps can provide savings of up to 50%. The benefits extend well beyond even improvements. Digitization can also protect bank revenue from harm. The potential of reducing leakage can be up to 5–10%.

1.Improved accuracy, zero paperwork

Sifting through voluminous data has been the inevitable cause of delays in loan processing. The front-end data flow requires extensive man-hours. But in a paper-less setting, the complications in the process are reduced. This can be seen from the initiation stage until the approval phase.

An automated lending system can manage the heavy volume of data. It can delegate transactions without missing a step. Signzy’s complete onboarding solutions can help in this regard. With AI-based proprietary technology, higher efficiency is easily guaranteed. Using computer vision, our solution is capable of processing almost 3.5 million documents in 1 day.

2. Greater Savings With Lesser Cost

Automation greatly reduces processing time. Thus the cost of doing business or processing a loan application will automatically drop. Credit and loan officers can utilize time to process more accounts.

Most importantly, lending firms can exempt the cost of hiring and training of additional personnel. Overall operating costs are greatly reduced. Automation can help reduce the cost of risk mitigation by 10–25%. Additionally, the overall costs are lowered by about 20%.

3. Optimize lending operations through APIs

A lending software solution can optimize all segments of the lending operation. However, the primary point of focus is always on the risk-assessment aspect.

Signzy uses proprietary APIs that our decision-making engine can use. These APIs can cross-check credit scores against EXPERIAN data. The checks are conducted against the Consumer Bureau database as well. The system checks for accurately retrieving the credit score of the borrower. This allows for a faster decision-making process.

4. Clients are the ultimate beneficiaries

The best customer experience is ultimately desirable in a streamlined credit management process. The processing of consumer, commercial or industrial loans is not a time-consuming affair. Automation can easily satisfy customer expectations.

Clients are not really concerned with the internal mechanism of the process. When all loan requirements ae fulfilled, the timer begins to count down. Most borrowers expect the processing of their loan applications to be timely.

New Trends In Lending — How Organizations Are Adopting To Automation

The onset of Covid-19 has set an inflection point for a spike in demand for contact-less and paper-less lending. This has fast-tracked digital transformation in the lending industry. This is similar to how demonetization catapulted digital payments in India.

NBFC’s have traditionally designed digital capabilities to drive cost-efficiencies and manage risks. However, the Fintech industry has shown digital prowess for improving customer experience.

Digital Analytics For Credit Analysis

FinTech’s have largely managed collections via data analytics led sms/phone/email communication. They have also employed limited on-ground collection teams. As a result, an increase in on-ground collections is viable. This can be either through in-house teams or collection-agency outsourcing.

There has also been a spike in partnerships with payment banks. The purpose of this is to enable customers to deposit cash at kirana outlets. It also entices the proliferation of awareness campaigns for customers to pay using UPI and similar methods.

Fintechs Play A Crucial Role In Digital Lending

In McKinsey’s Future of Risk Management Survey, data shows that 85% of risk managers believe legacy IT infrastructure to be the main challenge in digitization. To resolve this, many large financial institutions have collaborated with fintechs. For example, ING with Kabbage and BBVA Compass Bancshares with OnDeck.

The report also highlights new lending approaches. This includes automating SME credit decisions through the use of alternative data sources. Ex: e-commerce-transaction data from Amazon, PayPal, and eBay. Other examples include: cloud-accounting data from Xero and banking-transaction data via APIs. These are collected from financial-data aggregators such as Yodlee and Finicity). From these findings, it can be inferred that fintechs can play a key role for innovations in digital lending.

Conclusion

Traditional lenders seem to have a notion. They feel that an automated lending system is overrated. For them, a complex process like credit management is impossible to automate. They fear for the weakening of the lending process. On the other hand, sticking to the manual process poses bigger risks.

Moreover, a lending firm that processes loans at a turtle pace will not merit attention. Times have changed and credit risk processes are turning digital. Every player in the lending space needs a lending software solution.

Automation is essential in this day and age. Lenders can hit volume targets, increase profits while managing delinquencies and mitigating risks. It’s the new backbone of any lending business.

About Signzy

Signzy is a market-leading platform redefining the speed, accuracy, and experience of how financial institutions are onboarding customers and businesses – using the digital medium. The company’s award-winning no-code GO platform delivers seamless, end-to-end, and multi-channel onboarding journeys while offering customizable workflows. In addition, it gives these players access to an aggregated marketplace of 240+ bespoke APIs that can be easily added to any workflow with simple widgets.

Signzy is enabling ten million+ end customer and business onboarding every month at a success rate of 99% while reducing the speed to market from 6 months to 3-4 weeks. It works with over 240+ FIs globally, including the 4 largest banks in India, a Top 3 acquiring Bank in the US, and has a robust global partnership with Mastercard and Microsoft. The company’s product team is based out of Bengaluru and has a strong presence in Mumbai, New York, and Dubai.

Visit www.signzy.com for more information about us.

You can reach out to our team at reachout@signzy.com

Written By:

Signzy

Written by an insightful Signzian intent on learning and sharing knowledge.